ACTS' Method

|

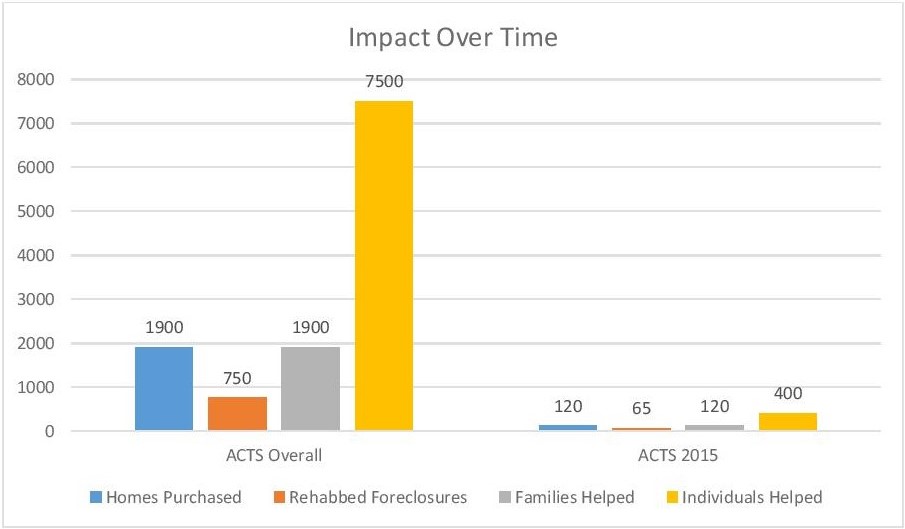

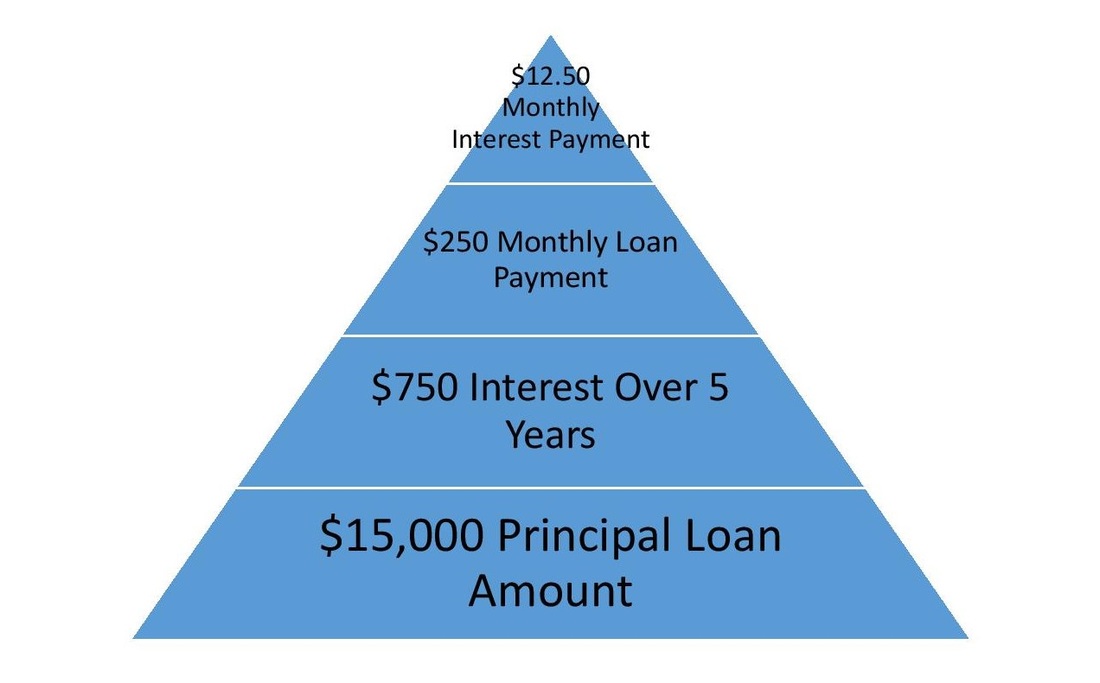

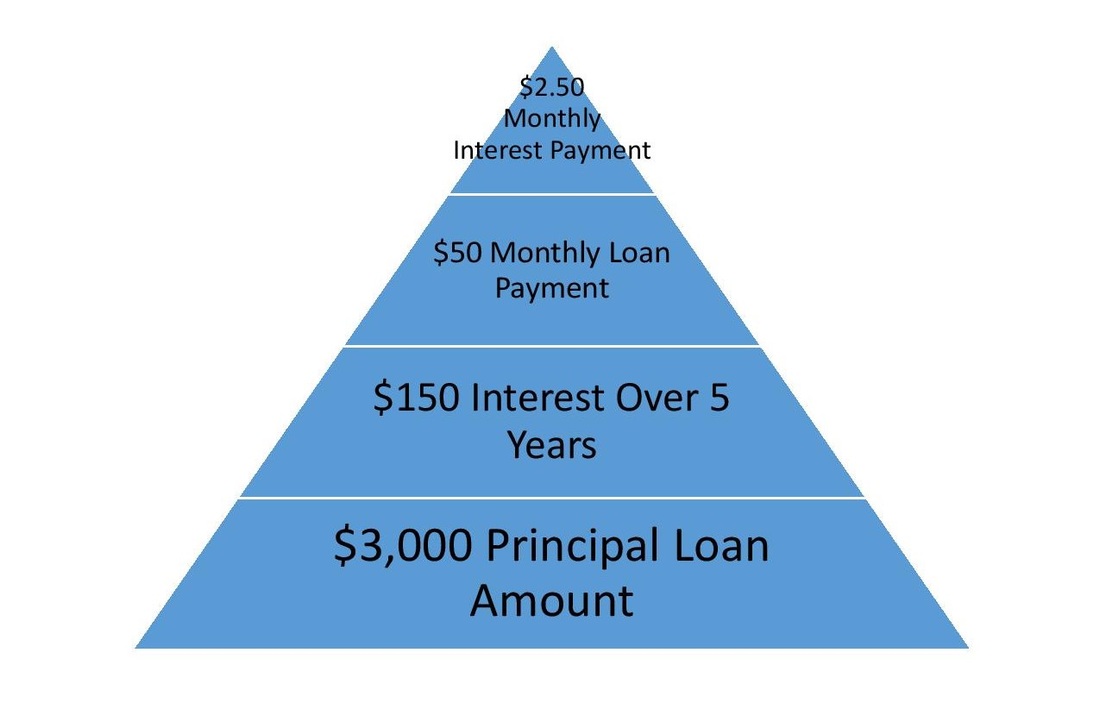

While the majority of financial institutions serve middle- and upper-class families, ACTS serves low-income families who other institutions might not do business with. Structured in a radically different method, ACTS Housing first began by giving out loans of up to $3,000 with 0% interest over 5 years. In addition to offering affordable loan plans, ACTS also works with families who have no credit or low credit. A few years ago, with the creation of the affiliate nonprofit, ACTS Lending, ACTS began to offer loans up to $15,000 at 5% interest over 5 years. The addition of interest cost is used to cover administrative costs and enables ACTS Lending to keep giving loans out.

ACTS Lending now works as a primary mortgage provider for ACTS families, along with private banks, who provide 40% of ACTS family's mortgages. In recent years, ACTS has shifted to a revolving loan fund through ACTS Lending. This simple fund, started by private donors, contributions, and banks' lines of credit, is recycled to new homeowners as it is repaid by other homeowners. ACTS does not give people homes. Rather, they partner the people who have challenges such as low income, lack of savings or no knowledge of how financial processes work. Instead of turning low-income families away, ACTS Housing and ACTS Lending embrace these families as the key to their success. By taking risks that other lending institutions are unwilling or unable to make, ACTS meets the needs of the communities they serve while also building a strong presence in the neighborhood. Through the financial counseling services provided, ACTS Housing gives families tools to navigate financial processes on their own. About 17% of ACTS homeowners have successfully sold their homes and bought new ones without the help of ACTS, while around 77% remain in their original ACTS home. Only 6% of ACTS families have foreclosed on their ACTS homes, which is well below market averages. By providing families the opportunity to build credit and learn crucial financial skills, ACTS interrupts the traditional path and seeks to include traditionally “risky” candidates in home-ownership culture. ACTS's loan portfolio is well above market averages. They are proud to declare that their loan portfolio is over 99% current. In order for their portfolio to be so strong, ACTS sometimes recommends that some families to work on outstanding loans and build their credit before beginning the home-buying process. Instead of continuing in the cycle of renting, the families who work with ACTS have the opportunity to build their lives through home-ownership and investment in their community. Most families are happy to work on their preexisting finances before taking on the home-ownership process, but this recommendation does require some families to take extra time in the financial counseling stage of the ACTS process. For families that face inordinate challenges, working on their credit before they are able to gain the security of home-ownership may take more time, yet this simply means that they are improving multiple areas of their lives as they work towards home-ownership. |